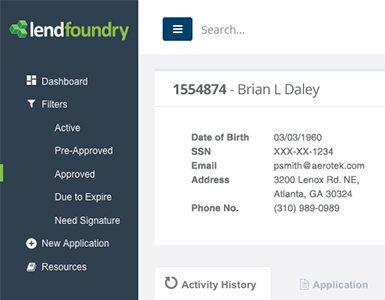

LendFoundry – Fintech Web App

This Lending operating system empowers marketplace lender to bypass costly tech built-outs, minimize IT infrastructure and accelerate the process in the lending market. LF enables market place lenders to focus on their core lending business, with access to the latest acquisition, underwriting technologies, readymade loan servicing software and portfolio benchmarking.

The platform is being built to serve the lending marketplace and it is now the trusted platform of choice, from start-ups to enterprises, including some of today’s largest online marketplace lending companies.

Goals

To provide a seamless and intuitive user experience that enables users to apply, manage, and repay loans.

Overall, the goal was to provide users with a convenient and efficient way to manage their loans, from application to repayment, while ensuring a secure and trustworthy experience.

Research

The dream of achieving rapid, large-scale process automation is becoming a reality for some lending companies. Competitors cannot afford to miss the opportunity to transform their own back-office processes.

Our research indicated that a significant opportunity exists to increase the levels of automation in lending offices. By reworking their architecture, lending companies can have much smaller operational units run value-adding tasks, including complex processes, such as deal origination, and activities that require human intervention, such as financial reviews.

By taking full advantage of this approach, lending companies can often generate an improvement of more than 50 percent in productivity and customer service.

My Role

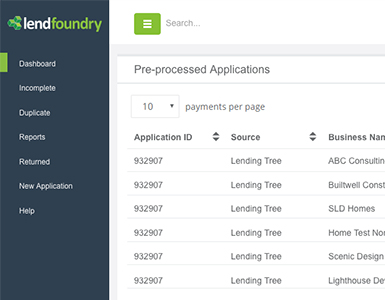

I worked with the company’s founder and CTO designing the workflow and the user experience and collaborated with US Development team in designing the interface for the desktop application. I was also responsible for the branding and visual design of the desktop platform.

Design Process

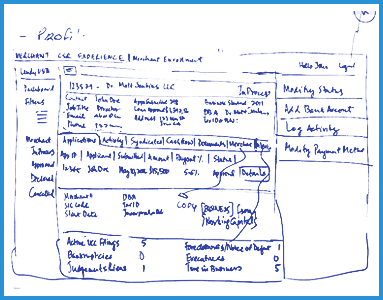

Due to the nature of the complexity of the project and the amount of compliance that takes place, the team needed to come up with a customizable solution that would provide end-to end lending solutions that covered different needs in the process from loan origination, marketing, acquisition, underwriting, loan servicing and maintenance.

Inductive Design Approach:

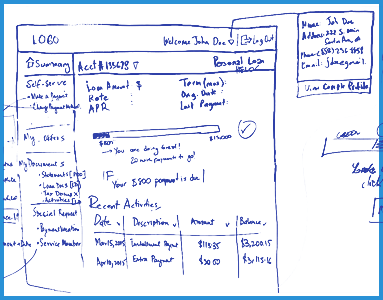

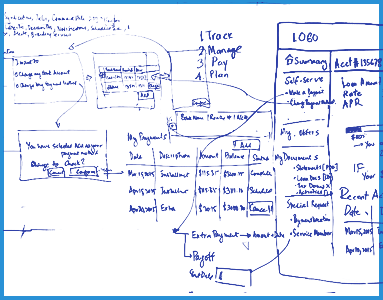

I worked very closely with the CTO creating wireframes for all the different scenarios and user profiles as every user would have a different set of tasks and responsibilities to accomplish in each given scenario. Once we defined the work flow, I worked on low-res prototypes, iterate until we agreed on a high resolution interface and experience for the platform.

Challenges

Designing a telematics app came with a unique set of UX challenges. Here are some of the challenges our team faced when designing these apps:

Information Overload: Telematics technology generates a lot of data and information, which can easily overwhelm users. I had to find multiple ways to present this data to our clients and users in a way that was easy to understand and act on. The goal was to render a platform on the cloud which can be easily scaled to suit the client’s needs.

Distractions: Driveway’s apps are mostly used while driving, which meant that distracted needed to be minimized. I had to make sure that the user experienced clearly covered all different states in a user journey with clear visual cues that could be quickly and easily understood.

Safety in Mind: Driveway’s apps are often used in safety-critical environments, so I had to ensure that their apps were designed with safety in mind, with features such as hands-free operation and clear, unambiguous alerts.

Data Privacy: Telematics technology generates a lot of data, which can be sensitive and private. As the Lead UX Designer I had to ensure that the app was designed with data privacy in mind, meeting all of the stakeholders privacy and clear user consent processes.

Results

LendFoundry provides all the tools lenders need to be successful, facilitate customer management, compliance, reporting, authentication and security, marketing, and enable a unified search functions.

Scalability: The goal was to render a platform on the cloud which can be easily scaled to suit the client’s needs.

Simplicity: Through pre-packaged integrations with credit bureaus, bank data provides, document handlers and marketing applications.

Intelligence: Build a platform with built-in analytics which assesses credit worthiness while churning data from multiple sources.

As a result, the amount of time back-office staff spent handling account changeovers fell by 70 percent; the time customers needed to adjust to the switch was reduced by more than 25 percent. The cost-benefit ratio for this project was also significantly better than it had been in previous automation efforts: the project generated a return on investment of 75 percent and payback in just 15 months.

LendFoundry is now the trusted platform of choice, from start-ups to enterprises, including some of today’s largest online marketplace lending companies.